|

|

Virtual Project Brokering |

Sound, Profitable, Ambitious Projects in search for Investor, Buyer or Partner.

MiD BAHIA BLANCA

PROJECT

by Diego Borgani, from Bahia Blanca, Province of Buenos Aires, Argentina

ABSTRACT

I - PRESENTATION

1.

PRODUCT

Music-searching

service

2.

DESCRIPTION

A person dials a four-digit number on a cell pone and points it at a source of recorded music, be it the sound system in a nightclub or a commercial on television. MiD’s computers filter out the background noise and compare the audio sample with a database of 1.6 million songs, a process that takes less than a second. The service then fires off a text message to the phone, identifying the song and the artist. Once MiD users are back at their computers, they can log on to the web page to see a list of the tracks they have identified, complete with links to online merchants that give MiD a sales commission. Also instant sales of CD’s, ring tones or even downloads of entire songs and video could be available

3.

PROCESS

The

process starts when a consumer hears a song or a piece of music broadcast over

the radio that he or she would like to buy but can not identify. That is a gap

in major radio stations, with playlists often lacking track indentification by

deejays. Provided the consumer subscribes to a service, all that’s necessary

is to dial into the service with a cell phone or fixed-line phone to enable a

fingerprint to be captured via the telephone handset. Audio is extracted, via

MiD’s front-end applications. These applications interface with the

fingerprint application interface, which computes a whole series of bit strings

called “sub-fingerprints” derived from the audio clip, each lasting several

milliseconds. 256 of these sub-fingerprints, corresponding to approximately 3

seconds of audio, are sufficient to uniquely identify a song. Then this

fingerprint block is sent to the fingerprint-matching server. The server

responds with either a unique song ID (a 64-bit number) which is transmitted to

a MySQL relational database server that supplies information on artist, title

and album to the fingerprint application interface.

A

minimum fingerprint-matching server system consists of 1 master and 1 slave PC.

Such a system is already capable of processing up to 25000 songs with an

average song length of about 4 minutes, and of processing in real-time up to 600

audio channels in parallel. Additional slave PCs can easily be added to the

system, each increasing the system capacity by 25000 songs.

4.

BACKGROUND AND PROSPECTS

Music electronic distribution begins since new technologies allow to

bring music

to the mass public. This improves with the dramatic increase of internet

users, cell-phones and added value linked contents. The size of musical

catalogues are also increasing, specially from playlists obtained “pier to

pier” (e.g.: Napster, Kazaa).

Music-searching

service represents an analogy with text-searching engines in internet. Music

identification software (e.g.:”audio fingerprinting”) or acoustic

identification have recently solved this alternative, taking advantage of hard

and soft developing, each time faster and powerfull.

Shazam

U.K. launches the service August

1st 2002

Since the introduction Shazam received millions in funding, closed deals

with portals like MSN, attracted more than 500,000 users in the U.K., announced

expansion into Germany (together with Vodafone) and are now eyeing the Austrian,

Dutch and Italian markets.

In

partnership with Philips technology, Musiwave (a subsidiary of Gracenote U.S.)

offers the music identification service in Spain (Amena) and Portugal (Optimus).

No

word on the rest of the world, so this is still an interesting arena for South

America

II

- BUSINESS MODEL.

- Stock Company.

Human Resources:

General

Manager.

System

Administrator

Legal

and Accountant Consultant.

Publicity

and Marketing.

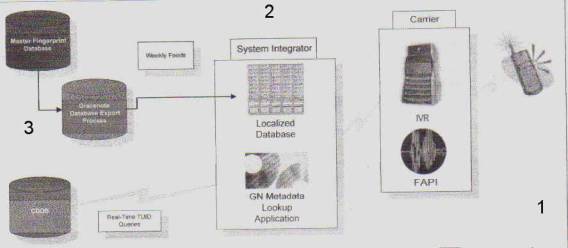

- Sub-systems:

System

Integrator

Telephone

Carrier

Data

Base and Identification Software

III –

MARKET SURVEY

1. CONSUMER ANALYSIS

Orientated to popular music, world wide distributed and available to

every kind of audience.

Music lover, with free time and interested in catalogues managing,

cellular phone user.

Interest begins since it is possible to access only a little portion of

catalogues, people cannot retain all what they have listened. The existence of

erroneous data from “pier to pier” sharing also leads to the necessity of

organize your own catalogue. Moreover there are albums that users do not know

but they would be interested in if they could get them. The challenge will be to

recognize the people preferences from well defined searching procedures.

To sum up, we talk about the band between 15 and 24 years old.

2. GLOBAL DEMAND ANALYSIS (source INDEC Argentina)

Market: Republica Argentina

Population: 36 millions inhabitants

Hypothesis: Potential cell phones users (15 to 70 years old): 23.5

millions.

Cell phones on service: 11 millions, representing 46.8% of population

hypothetically using cell phones.

Potential users of added value services on cell phones located in the

band between 15 to 24 years old: 6.4

millions.

The 46.8% of this band represent 3 millions of potencial customers and it

is a discreet figure taking into account that it will be more concentration of

devices in this group comparing with the other one from 25 to 70 years old.

3. PROJECT DEMAND (source

INE, España)

Music identification services are recent and there are not accurate

statistics. Nevertheless we do know

that in Spain (cultural affinity) a monthly average of 500.000 services

were registered during the first semester. A comparative analysis as

follows:

Market: Spain

Population: 41 millions inhabitants

Hypothesis: Potential cell phones users (15 to 70 years old): 30

millions.

Cell phones on service: 30 millions, representing 100% of population

hypothetically using cell phones.

Potential users of added value services on cell phones located in the

band between 15 to 24 years old: 5.6

millions.

The 100% of this band represent 3 millions of potential customers.

Scope

5.6 millions of users making a monthly average of 500.000 phone calls

requiring the service during the first semester.

Then 3 millions of users making 267.857 phone calls per month in

Argentina or 3.214.286 phone calls per year.

Taking into account a 90% effectiveness in the recognition: 2.892.857

phone calls per year.

Standard Engagement

The standard engagement allows 30 phone calls per minute and if them are

made in a band of 12 hours (normal), we have 21.600 phone calls in a day,

648.000 in a month and 7.776.000 in a year.

This extra performance supports any seasonal increment, if it comes into

fashion, due the innovation or market break out in the future.

Whit reference to the project lifetime (only 5 years due product

characteristics), a prudent background is adopted, this means a saturated and

still cell phone market, without growing population.

Anyway we must consider that 11 millions users are from September 2004,

meanwhile in September 1999, 3.6 millions were registered (dramatic increase).

Since the second year a share market of about 25% is abandoned to end the

project with only a 50%, in the conservative hypothesis that the competitors

can reach the new technology (even though Mid Bahía Blanca still keeps

the advantage of being the first and moves into the linked contents market).

Project Demand (x 1000

phone calls)

|

Year |

|

2005 |

2006 |

2007 |

2008 |

2009 |

|

Global

demand |

2.893 |

2.893 |

2.893 |

2.893 |

2.893 |

|

|

Share |

|

100% |

75% |

50% |

50% |

50% |

|

Project

demand |

2.893 |

2.170 |

1.446 |

1.446 |

1.446 |

|

For

the present project other incomes due linked contents and trade through the web

page are not taking into account.

4. SUPPLY ANALYSIS

This service has no local supply. Nevertheless a quick response from

competitors is expected. Specially those that already operate in cell phones

linked contents, most important as follows:

Ringtones MP3

MTV LA

Ubbi Móvil

Toing

Moviclips

Operating through Telephone Companies:

Telefónica de Argentina (Telefónica de España), recently purchasing

Movicom (Bell): 5.5 millions customers (Unifon now Movistar). 50% share market.

Telecom (Stet Italy and France): 2.9 millions (Personal). 26%

Compañía Telefónica del Interior (América Móvil): 2.6 millions

(CTI). 24%

Total 11 millions of users.

5. PRICES.

Share.

Call

price

U$ 1

Carrier

share

U$ 0.30 30%

Mid Bahía Blanca U$ 0.15

15%

Database

/ Soft U$

0.55

55%

Income of Mid Bahia Blanca

is collected monthly from the carrier.

-

BUSSINESS STRATEGY

Main

condition is to go first into the market, together with an aggressive publicity

campaign in youth media all over the country. This will improve the recognition

and the empowerment of the brand.

Of

course in a short term competitors will appear, being phone operators or

companies already at linked contents. The first case resulting in a double risk

since it can affect the availability of one of the resources. Actually the phone

company can manage the project by itself (Amena case in Spain), it is not a

great investment and it means an added value. Nevertheless, the model “system

integrator” providing the service to a telephone carrier is possible

(“Shazam” U.K.). Alternatives supporting this model as follows:

1)

To provide the service through an “Added Value in Telecommunications”

operator (also known as “0609” lines).

2)

To be a partner of a unique telephone company which will be very well identified

by his innovative and original service, standing out from competitors, and

provided with the advantage of a ready made product supported by the registered

owners.

Anyway

in this country it is a fact that linked contents are not operated directly by

telephone companies.

To

sum up, a very important thing is that once the company can step on music

identification market, other options of added value will be able to exploit, as

selling and delivery of songs, ring tones download, videos, wall papers, etc..

(Statistics in Europe show that 20 from 100 music identification phone calls

lead to a purchase of other products). In fact, this is the actual opportunity

for this project. In such a dynamic sector like being technology oriented to

entertainment, to move into the market with an innovative product will allow to

go on providing a whole chain of services.

III TECHNICAL SURVEY

Standard

Engagement (recommended).

-

Database size: 250.000 fingerprints.

-

Each server array can andel about 30 calls/minute.

-

Configuration: 1 master server, 11 slaves (one slave is standby in case a live server fails).

Total

time to install: approximately 6-8 weeks.

System

Process Flow Detail.

-

Incoming call from customer.

-

Fingerprint is extracted and sent to local database.

-

From local database fingerprint passes to servers where they are recognized and sent back to the user as an identified song.

Round-trip time: approximately 10 seconds.

IV FINANCIAL SURVEY

1) INVESTMENTS

a)

FIXED ASSETS

|

Software |

U$D 70.000 |

|

Hardware (including import taxes 50%)* |

U$D 90.000 |

|

Data

Base |

U$D 19.000 |

|

TOTAL

FIXED ASSETS |

U$D

179.000 |

*Avoided if system is installed in a free zone (eg.: General Pico, La

Pampa Province)

b)

ACTIVE ASSETS

(To

afford 30 days displacement)

|

TOTAL

ACTIVE ASSETS |

U$D

5.125 |

2) OPERATING COSTS (annual)

Software maintenance

U$D 10.500

Data base maintenance

U$D 51.000

Total

Operating Costs

U$D 61.500

3) OPERATING EXPENSES (annual)

General

Manager

U$D 32.000

Tax

rate and services

U$D 18.000

Promotion,

publicity and marketing

U$D 90.000

System

Administration and Maintenance

U$D 7.000

Legal

and Accountant Consultancy

U$D 4.000

Total

Operating Expenses

U$D 151.000

|

CASH FLOW |

|

|

|

|

|

|

|

|

PHONE CALLS QTY |

|

|

2893000

|

2169750

|

1446500

|

1446500

|

1446500

|

|

YEAR

|

|

0 |

2005 |

2006 |

2007 |

2008 |

2009 |

|

INCOMES |

|

|

433.950 |

325.463 |

216.975 |

216.975 |

216.975 |

|

COSTS

|

|

|

-61.500 |

-61.500 |

-61.500 |

-61.500 |

-61.500 |

|

EXPENSES |

|

|

-151.000 |

-121.000 |

-121.000 |

-121.000 |

-121.000 |

|

DEPRECIATION

(hardware) |

|

|

-12.000 |

-12.000 |

-12.000 |

-12.000 |

-12.000 |

|

GROSS

PROFIT

|

|

|

209.450 |

130.963 |

22.475 |

22.475 |

22.475 |

|

TAX

RATE |

|

|

-73.308 |

-45.837 |

-7.866 |

-7.866 |

-7.866 |

|

NET

PROFIT

|

|

|

136.143 |

85.126 |

14.609 |

14.609 |

14.609 |

|

DEPRECIATION |

|

|

12.000 |

12.000 |

12.000 |

12.000 |

12.000 |

|

FIXED ASSETS |

|

-179.000 |

|

|

|

|

|

|

ACTIVE ASSETS |

|

-5.125 |

|

|

|

|

|

|

RESIDUAL

VALUE |

|

|

|

|

|

|

58.435 |

|

CASH

FLOW |

|

-184.125 |

148.143 |

97.126 |

26.609 |

26.609 |

85.044 |

|

|

|

|

|

|

|

|

|

|

*Sold qtys. refer to market survey |

|

|

|

|

|

|

|

|

*Call price (share) U$D 0.15 |

|

|

|

|

|

|

|

|

*Costs and expenses refer to

financial survey |

|

|

|

|

|

|

|

|

*Investments refer to financial

survey |

|

|

|

|

|

|

|

|

*Residual value by economical

method |

|

|

|

|

|

|

|

|

*Depreciation period 5 years

(hardware) |

|

|

|

|

|

|

|

|

*Tax

rate 35% |

|

|

|

|

|

|

|

|

*Discount rate 25% |

|

|

|

|

|

|

|

|

CURRENT

NET VALUE |

|

48.939 |

|

PB

RATE |

41% |

|

|

Author's

email

|

Email your Project - Approval and posting fee: $19 per year. - If your project is rejected there are no appeals. A short explanation will be provided about the reasons for rejection. |

If needed you will get our phones, address and videoconferencing contact data

Buenos

Aires, Argentina

Business Brokers ©

2005 Netic Infoservices